Recently, I’ve been exploring Bitcoin network and came across an intriguing project called the Liquid Network. Developed by Blockstream, its goal is to provide instant Bitcoin transactions and support additional features. This article will introduce the basic concepts of the Liquid Network, along with its advantages and applications.

Background

Why Are Sidechains Necessary?

Network Congestion

As the number of Bitcoin users increases, so does the transaction volume. However, Bitcoin’s block size is limited, and each block can only accommodate a finite number of transactions. This leads to delays in transaction confirmations and rising fees.

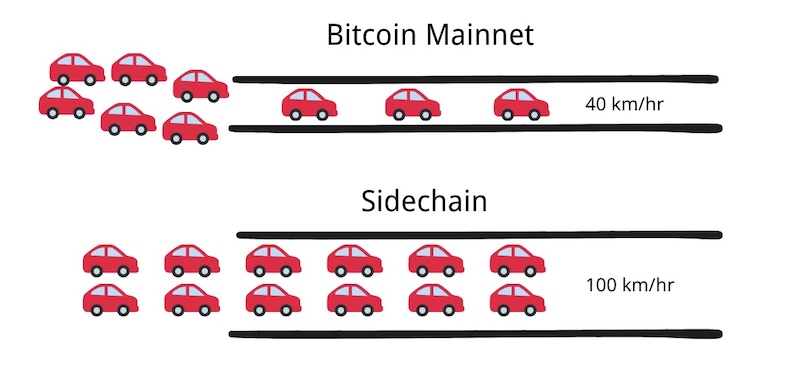

An everyday analogy: Imagine the Bitcoin network as a road where only 100 cars can pass every 10 minutes, but now 10,000 cars want to get through. What happens? The road manager is practical: the more you pay, the sooner you’ll be allowed to pass. If you don’t want to wait, you’ll have to pay higher fees. Even if you’re wealthy and want to reach your destination in one minute, sorry, no amount of money can help because the road’s speed is fixed; you just have to wait.

This is why sidechains like the Liquid Network have become so important. Sidechains operate in parallel with the main chain, aiming to enhance transaction efficiency and functionality without altering the main chain’s protocol. You can think of it as building an express lane alongside the main road to handle more traffic. We can move vehicles (Bitcoins) onto this express lane for faster and cheaper transactions when needed and then move them back to the main road at an appropriate time.

Complexity of Main Chain Upgrades

Directly upgrading the Bitcoin core protocol is highly complex and often faces community resistance, along with inherent risks. In the past, such situations have even led to hard forks and splits within the Bitcoin community. This is why sidechains like the Liquid Network have become a more practical option for enhancing Bitcoin’s functionality—they allow for innovation and improvements without changing the main chain.

What Is the Liquid Network?

Launched in September 2018, the Liquid Network is a Bitcoin settlement network based on a sidechain, designed specifically for faster and more private transactions. It operates in parallel with the Bitcoin main chain, allowing users to move Bitcoins onto the Liquid sidechain for faster and cheaper transactions. Once completed, users can move their Bitcoins back to the main chain.

Advantages:

- Faster Transactions: The Liquid Network processes a block every minute, whereas the Bitcoin mainnet processes a block every 10 minutes on average. This means transaction confirmations on the Liquid Network are faster, which is crucial for scenarios requiring timely operations.

- Lower Fees: Transaction fees on the Liquid Network are significantly lower than those on the Bitcoin network—reduced by more than a hundredfold. Additionally, since Liquid doesn’t require mining, transaction fees aren’t affected by mining difficulty or network congestion.

- Confidential Transactions: The Liquid Network employs confidential transaction technology, hiding the amounts and types of assets in transactions to provide stronger privacy protection. This is particularly beneficial for businesses and traders who wish to keep their financial activities private. For general users, it’s also advantageous—few people want others to know their account balances.

- Issuance of New Assets: The Liquid Network allows users to issue new assets, such as stablecoins and security tokens, enabling businesses to create and manage their own digital assets.

How It Works

Two-Way Peg System

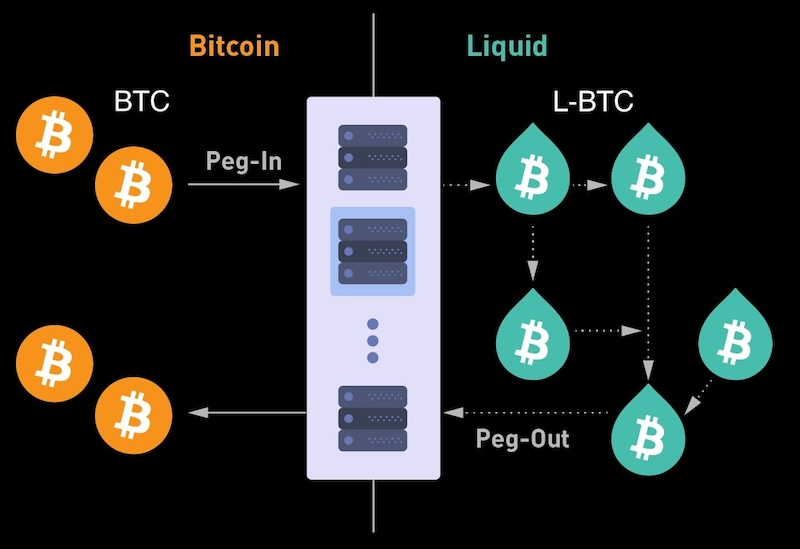

Moving BTC between the Bitcoin mainnet and the Liquid Network involves two key steps: Peg-in and Peg-out.

(image source: Blockstream)

(image source: Blockstream)

- Peg-in:

- Users send BTC from their mainnet wallets to a specific address on the Liquid Network.

- These Bitcoins are locked in a multi-signature wallet controlled by the Liquid Federation.

- An equivalent amount of Liquid Bitcoin (L-BTC) is issued to the user and appears on the Liquid Network.

- Peg-out:

- Users send L-BTC to a designated address on the Liquid Network.

- An equal amount of L-BTC is destroyed on the Liquid Network.

- The corresponding BTC is released from the multi-signature wallet and sent to the user’s Bitcoin mainnet address.

Several platforms can assist with Peg-in and Peg-out operations, including Sideshift, SideSwap, and Aqua Wallet. I’ll introduce how to use these platforms in another article when I have time.

Federated Consensus

Unlike Bitcoin’s decentralized proof-of-work consensus mechanism, the Liquid Network relies on a “Federated Consensus” model. It’s operated by a federation of 67 members, with 15 serving as “functionary nodes.”

These functionary nodes are responsible for the following key tasks:

- Signing Blocks: Without relying on miners, functionary nodes take turns proposing and signing new blocks on the Liquid Network, achieving faster block times.

- Managing the Peg Process: They oversee and ensure the secure peg-in and peg-out processes of Bitcoin entering and exiting the network, guaranteeing a 1:1 backing of L-BTC with Bitcoin.

This federated model is significantly different from Bitcoin’s decentralized approach and introduces an element of trust in the federation members. However, the Liquid Network aims to balance security, efficiency, and decentralization through multi-signature schemes and mutual checks among federation members, reducing the need to trust a single entity.

Comparison

Liquid Network vs. Lightning Network

Both the Liquid Network and the Lightning Network aim to solve the scalability issues of the Bitcoin mainnet, but they belong to different technological categories and address different needs:

| Feature | Liquid Network | Lightning Network |

|---|---|---|

| Type | Sidechain | Layer-2 Solution |

| Purpose | Faster transaction settlement, asset issuance | Instant micropayments |

| Transaction Size | Suitable for larger transactions | Suitable for smaller transactions |

| Transaction Speed | Approximately 1-minute block time | Near-instant |

| Privacy | Confidential transactions hide asset amounts and types | Offers limited privacy |

| Decentralization | Operated by a federation, relies on functionary nodes for consensus | More decentralized, operates via payment channels |

The Lightning Network is based on the concept of payment channels. Two users establish a channel between them, allowing multiple two-way transactions without touching the main chain. When the channel is closed, the final transaction results are submitted to the main chain. This makes transaction speeds nearly instantaneous and fees extremely low, ideal for small, high-frequency transactions.

As a sidechain, the Liquid Network allows assets to be transferred between the main chain and the sidechain and traded on the sidechain. Its block time is fixed at one minute, suitable for larger transactions and asset issuance. Additionally, the Liquid Network supports confidential transactions and multiple asset types, catering to the needs of institutional investors and exchanges.

In summary, the Lightning Network is more suitable for everyday small payments, such as buying coffee or tipping, while the Liquid Network is better suited for larger transactions requiring quick settlement and high privacy, such as settlements between exchanges and institutional investments.

Conclusion

The Liquid Network offers an attractive solution to enhance the Bitcoin network, especially for businesses and institutions handling large-scale transactions. Its advantages include faster transaction speeds, lower fees, and higher privacy. It’s important to note that due to the federated consensus model, the degree of decentralization is lower. However, this is essentially the blockchain trilemma—trade-offs are inevitable.

The blockchain trilemma refers to decentralization, security, and scalability.